Advancing warily since 2005, the carbon market is gaining traction in Europe. Under increased pressure from regulators and ESG-focused investors, corporates must adapt. Green-ty Advisory introduces this important market sometimes not well-known by financial actors.

Carbon market : flagship measure toward carbon neutrality

The European carbon market (or EU Emission Trading System) is an essential tool for the ecological transition at European scale. It is a pillar of Fit for 55, the package of proposals from the European Commission to reach carbon neutrality in 2050.

Its principle is simple : make greenhouse gas (GHG) industrial emitters pay for their emissions, in particular for CO2. Each ton of CO2 emitted should be compensated by the purchase of a right to pollute (« allowance »). This financial instrument is purchased and sold on the EU ETS, a market regulated by Europe.

Beyond the concept, the setup is without surprise very complex. It raises many questions and poses challenges to the market participants.

Application perimeter and measurement methods of the Carbon market

First challenge : to whom do the rules apply ? Which emissions should be taken into account ?

With Fit for 55, the EU ETS is widened compared to its original scope of implementation.

First, it applies to more and more sectors. Fit for 55 plans an extension to sea and road transport as well as construction. Up to now, these sectors were not included.

Second and even more importantly, it includes new tools for the regulator. For the first time Fit for 55 includes the « carbon leakage» concept and extraterritoriality of emissions. The idea here is to avoid the simple relocation of emitters out of Europe, enabling a superficial neutrality without global impact. The Carbon Border Adjustment Mechanism (CBAM) therefore plans to tax goods produced in countries without carbon compensation then imported into the EU. Needless to say, CBAM will trigger complex technical, financial and regulatory debates before being rolled-out.

As of today, the European Carbon Market scope involves approximately 40% of industrial emissions for more than 10 000 installations.

Depth and stability of the Carbon Market

Second challenge : how to dimension the carbon market to simultaneously respond to the demand and converge towards carbon neutrality ?

EU ETS allowance supply is a limited and shrinking market. The regulator defines the total number of quotas available per year and this figure decreases gradually. Within this enveloppe, the supply and demand are balanced thanks to a classic trading mechanism. Operators with excess quotas can sell their surplus to operators with a shortfall.

How do these exchanges take place exactly ? At ETS inception in 2005, emitters received emission quotas for free. Gradually, an auction mechanism organised by member states replaces free allowance. Agence France Trésor manages the auctions through an exchange platform called EEX (European Energy Exchange) for France.

The European strategy therefore consists of finding a balance between :

- Reducing GHG emissions toward Carbon neutrality

- Maintaining industrial activity

- Balancing a market strongly impacted by economic slowdowns

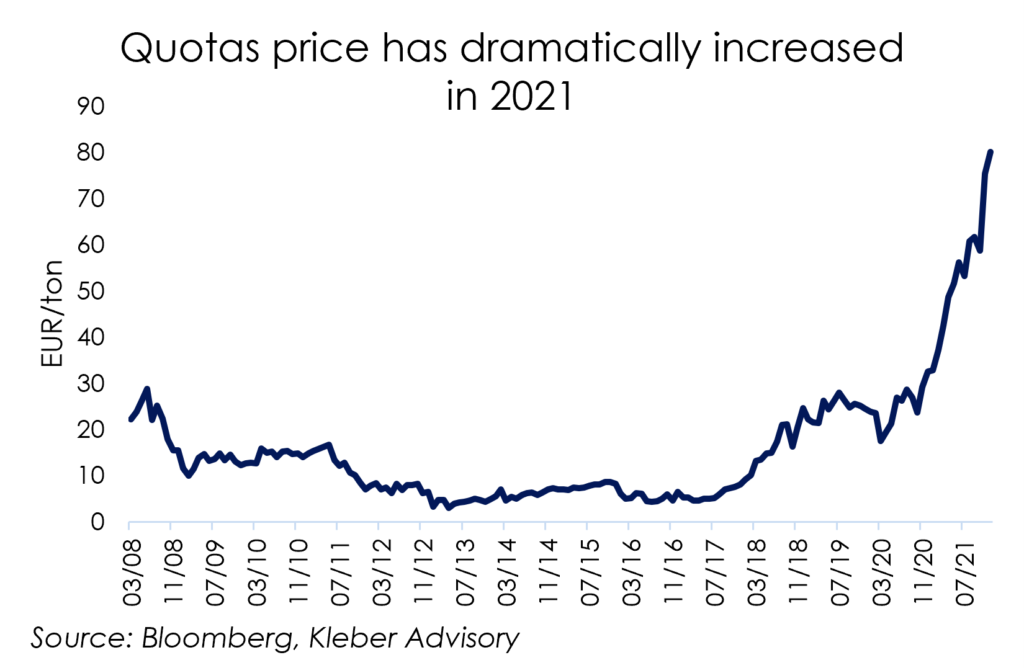

The need for stability demands specific measures to maintain market efficiency. The 2008 financial crisis triggered a drastic fall in demand and a sustained collapse of CO2 market prices. To avoid such a situation going forward, a Market Stability Reserve (MSR) was added to the EU ETS in 2019. The MSR is designed to manage the quota volumes available on the market. Quotas placed in the reserve are no longer available for auctions. This volume is corrected annually by a release or withdrawal of quotas from the reserve to maintain the equilibrium between demand and supply.

European competitiveness at stake

Fit for 55 accelerates environmental measures and the EU ETS market is no exception. More sectors, less quotas, carbon-based import tax… These decisions are accompanied by an increase in quota prices in 2021. Some European states consider this as an indication that EU ETS is subject to intense speculative pressure. Worse, some fear a massive loss of competitiveness of European economic actors due to high and unpredictable quota costs.

However ESMA – European market regulator – shows in a preliminary report that the weight of speculative financial actors on the market is not abnormally high.

Regarding competitiviness, it bears the consequences of the energy market trend, as shown by the Commission. The sharp rise in gas prices in 2021 caused an increase in coal-based electrical production. However, the cost of quotas linked to coal are logically higher than that linked to gas. CO2 emissions for the same quantity of electricity are indeed higher with coal compared to gas. Direct consequence : producers’ margins suffer from this increase in cost.

Beyond the market trend, it is hard to deny that EU ETS is an additional cost to european companies. As a result, Europe plans a Carbon Border Adjustment Mechanism (CBAM), previously mentioned in this article, to ensure efficiency and fairness of the EU ETS system.

An organizational challenge for the finance department

It is no longer a choice : finance departments will need to include the carbon market in their financial risk management.

First of all, an important effort is necessary to understand the risk borne by the company. All appropriate carbon policy demands an analysis of the risk and the regulatory environment. For finance department, increasing awareness and readiness requires a tranversal impact analysis, probably involving the purchasing and operations teams.

In a second step, an operational knowledge of the market is required: objectives, actors, instruments, etc. As an additional complexity, habits acquired on the FX market are not all transferable. Contrary to FX – generally well known by treasurers – the carbon market is mainly based on futures contracts dealt on EEX or ICE. The extreme efficiciency of FX markets will be hard to replicate. This could be disturbing to some operators less used to commodities market in a broad sense.

Finally, organizational and system evolution must be addressed : instruments, management follow up, accounting… Here again, a copy like for like of current processes will not work.

A brand new topic in its objectives and mechanisms, the carbon market is an interesting challenge for finance professionals and their partners.

Green-ty Advisory publishes articles on a regular basis dedicated to treasury and finance:follow us on linkedin!